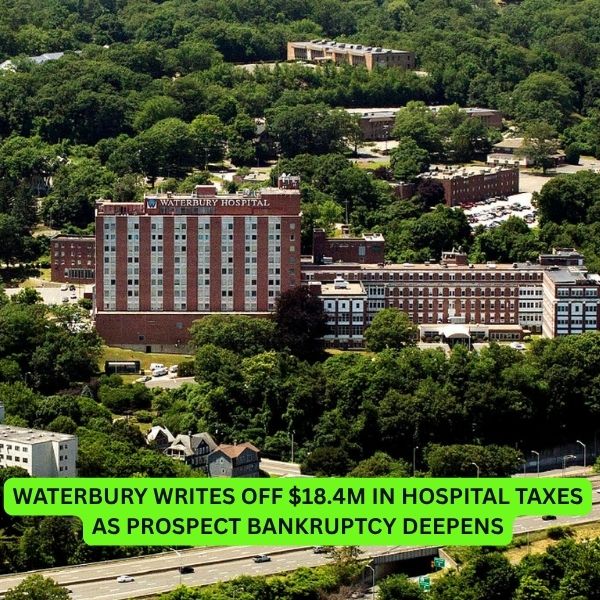

WATERBURY — City officials have placed $18.4 million in unpaid property taxes from Waterbury Hospital on the suspense list, declaring them uncollectible due to the ongoing bankruptcy of its parent company, Prospect Medical Holdings.

The Board of Aldermen approved the move Monday following a recommendation from Tax Collector Frank Caruso, who cited the uncertainty of collecting the delinquent taxes for 2024 and 2025.

Taxes Suspended, Not Forgiven

This Article Includes

The suspended taxes — $9.5 million for 2024 and $8.9 million for 2025 — will remain on the books and accrue 18% annual interest, with the city retaining the right to collect them for up to 15 years. But the city has removed them from active receivables in its financial reports.

“We know at some point we’re going to get something,” Mayor Paul Pernerewski Jr. said, “but it is not going to relate to the numbers that we’re showing on the books.”

Prospect Medical Holdings filed for Chapter 11 bankruptcy protection in January in Texas, citing financial distress tied to real estate deals and mounting debt. The situation has left cities like Waterbury holding the bag on unpaid taxes.

A Complicated Ownership Web

The challenge is further complicated by a 2019 sale-leaseback deal Prospect made with Medical Properties Trust, a real estate investment firm. The arrangement split the hospital’s ownership from its operations, with the land now held by MPT Waterbury PMH LLC — a move that’s complicating efforts to sell the facility.

Pernerewski stressed that any sale of the hospital must include both the building and the land to be viable.

“No one is going to buy the hospital as an ongoing entity if they have to continue the relationship with the holding company,” he said.

Hospital Auction Attracts Four Bidders

As part of the bankruptcy, Waterbury Hospital, along with Manchester Memorial Hospital and Rockville General Hospital, are up for sale via bankruptcy auction. The process is being coordinated by investment banking firm Houlihan Lokey, with four bidders currently in play.

MPT has agreed to help facilitate the sales, signaling willingness to resolve lease entanglements that could block transactions.

$22M Still Owed for Previous Years

Beyond the 2024–2025 taxes, Waterbury is also owed nearly $22 million in property taxes for 2022 and 2023. The outcome of the bankruptcy could impact how much, if any, of those taxes the city can ultimately recover.

Tax Appeal Still Pending

Prospect is also suing the city over the hospital’s assessed value. In 2023, the company challenged the city’s $171.7 million assessment — a $29.6 million increase following a 2022 revaluation. That case is expected to go to trial later this year.

As Waterbury navigates a tangled web of bankruptcies, lawsuits, and unpaid taxes, city officials remain cautiously hopeful that some recovery is possible, but expectations are tempered by the complex and slow-moving nature of the court process.

Leave a Reply